car lease tax write off

Tax deductions on the other hand only reduce the amount of your business income thats subject to tax. Haggle over the value of the car.

How To Take A Tax Deduction For The Business Use Of Your Car

Under some circumstances you could claim gas tax deductions.

. In the first year if you dont claim bonus depreciation the maximum depreciation deduction is 10100. Your estimated IRS mileage deduction is 34500 over the course of your lease. Under a capital lease the lessee is essentially buying the asset from the lessor with the lease payments functioning as a financing arrangement.

If the lease meets one of these four criteria it must be. If the car emits above 130gCO2 you cant reclaim 15 of this however. If you purchased a new vehicle during the tax year the IRS limits write-offs for passenger vehicles.

Usually that happens when you are self-employed and drive to and from your destinations for work. So if you get a 500 tax credit for example you can lower your tax bill by 500. That means if you make 36000 a year the car price shouldnt exceed 12600.

Most tax incentives come in two forms. Under certain circumstances you can write-off 100 of business expenses like meals or entertainment. As we see at the time of writing Toyotas lease deal pricing on the RAV4 Prime which up to Tuesday qualified for the full 7500 EV tax.

Whether youre paying cash leasing or financing a car your upper spending limit really shouldnt be a penny more than 35 of your gross annual income. Add up all the costs associated with your leased car. Car rental customers will typically find their options limited to whatever is on the rental lot and they may get a car that is a year or more old.

Fees and taxes were 500. How to Write That Expense Off On Your Taxes. The only exception here would be if your vehicle is a business car or a car that you use for both personal use and business use.

However as an ordinary commuter you cannot claim gas tax write-offs since millions of people are in a similar position. In the latter case you can only deduct the business use percentage of interest paid as the interest paid on a car for personal use is never tax deductible. The rental company is responsible for all of the maintenance registration fees and unexpected repairs.

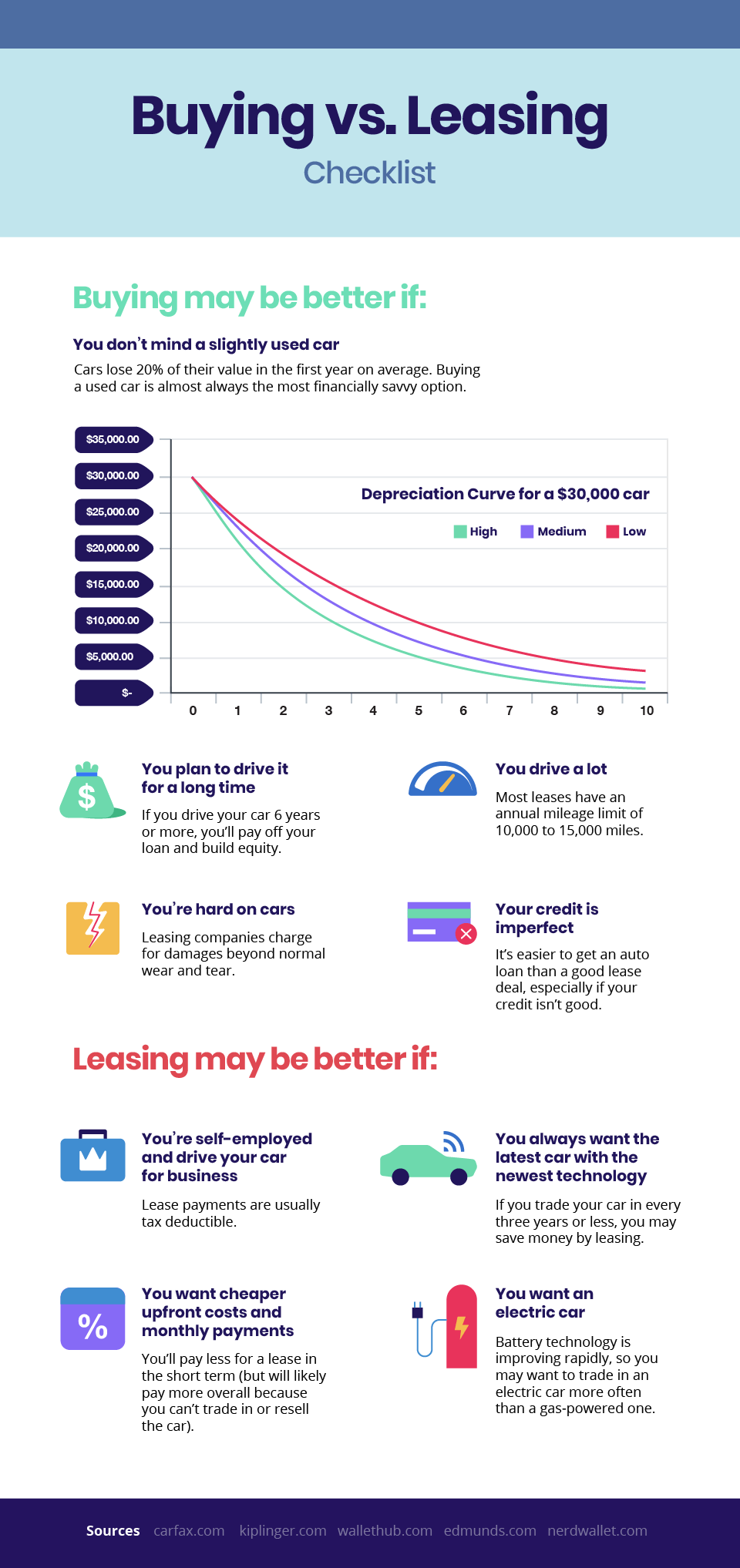

If its an old car there is no depreciation write-off. If you lease a new vehicle for 400 a month and you use it 50 of the time for business you may deduct a total of 2400 200 x. Many people lease cars to make it easier to write off as a business expense.

Loan interest and insurance were 1500. 3000 500 1500 5000. In this section well look common tax write-offs for sample small businesses.

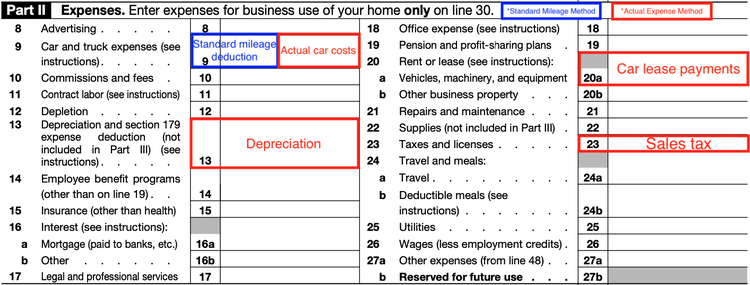

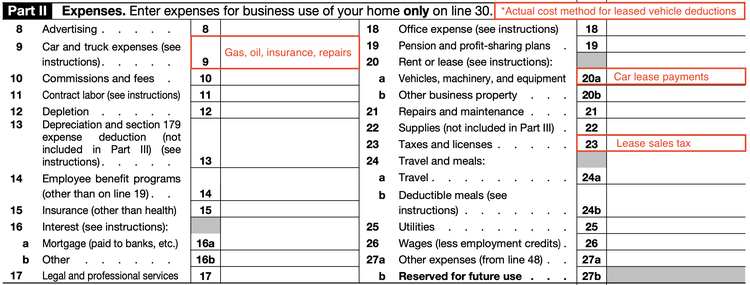

You have two options for deducting car and truck expenses. The best tip is to keep a detailed log of all vehicle expenses and take note of the following. Lets say your gas oil and repairs came to 3000 for the year.

Keep in mind that to write off auto lease payments or vehicle loan interest the car would need to be used solely for business purposes. Tax credits reduce your tax bill dollar-for-dollar. Many off-lease cars that are not bought by their lessees however are sold.

Cost of the car. Instead the end of one lease will mark the start of their next new car lease. When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments.

Tax Write-Off Examples. Heres How Much Car You Can Afford Follow the 35 Rule. These expenses replace the mileage-based deduction you take with the standard mileage method.

Photo Credit Mercedes-Benz USA Mercedes G Wagon Lease Vs Purchase Lease Example Calculation. When you lease a new car you get to choose the specific model trim level options and color. Tally your car lease costs.

A small painting business can claim car mileage as a tax. If you bought it a few years. Tax credits and tax deductions.

Your total actual expenses were 5000. Miles driven gas purchases repairs and maintenance licensing and registration fees car insurance lease payments and car washes these are all costs associated with your vehicle that you can write off. With a leased car theres no need to navigate the used car waters either at the time of purchase or at lease return.

To write off. Tolls and Parking Fees. Write Off Lease Cost As Business Expense - You are able to write off your monthly payments as a business expense.

If all you care about is the lowest monthly payment then leasing is one way to get there. The cars residual value is set at the beginning of the lease and wont change at the end of the contract. What you can write off with the actual expenses method.

Depending on the medium you can write-off a portion or all of your media advertising costs. Value of Your Trade-in The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the Value your trade-in.

If you do claim bonus depreciation the maximum write off is. Your total mileage was 18000 and documented business miles were 16200. By saving receipts and keeping detailed.

Naturally most lessees wont drop off the car and walk away. Insurance Lease payments Maintenance. If you lease a vehicle you get to write off the actual amounts you paid for example if you lease Mercedes G Wagon 36 Month Lease and Put 36000 Down PaymentLease Buy Down and 2500 Per month for the entire year.

If you finance your car then you can write off your own car payments. Company Car Tax - You need to pay company car tax on a car lease unless youre a sole trader. If you use a vehicle for personal reasons and business purposes the deduction would be a portion of the interest or lease payments.

Consider the criteria for a capital lease. The first is using your actual expenses which include parking fees and tolls vehicle registration fees personal property tax on the vehicle lease and rental expenses insurance fuel and gasoline repairs including oil changes tires and other routine maintenance and depreciation. Disadvantages of Leasing through a Limited Company.

For expenses that are both personal and business in nature you can only write-off the portion of the costs that relate to the business. What you wont have to do. These write-offs are not comprehensive but give an idea of what different businesses could deduct on their taxes.

Lease payments insurance costs.

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Writing Off A Car Ultimate Guide To Vehicle Expenses

How I Write Off My Dream Car Pay 0 In Taxes Youtube

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

How To Write Off A Car Lease For Your Business In 2022

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Write Off A Car Lease For Your Business In 2022

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Write Off Vehicle Payments As A Business Expense

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos